Friendly fraud begins like any regular transaction. A customer makes a real purchase using their own credit card—nothing seems off. But then comes the chargeback. They claim the transaction was unauthorized or that the item never showed up—sometimes with good reason, but often to game the system. The refund gets processed, and just like that, your business loses money on a perfectly valid sale.

This is friendly fraud. It’s sneaky, it’s growing, and it’s costing businesses billions. Unlike classic fraud, where someone uses a stolen card, friendly fraud comes from real customers who make legitimate purchases but then claim less-than-legitimate refunds.

In this guide, we’ll explain what friendly fraud is, why it’s on the rise, how it affects your bottom line, and how you can stop it—before the chargebacks start piling up.

What is friendly fraud?

Friendly fraud doesn’t involve stolen cards or hackers breaking into your system. Everything looks normal: the payment clears, the shipping info matches, and the customer seems legit. But after the purchase, they dispute the charge with their bank—even though they got exactly what they paid for.

Sometimes, it’s an honest mistake. Other times, it’s intentional. Either way, the business loses both the money and the product—usually with no warning.

Friendly fraud is hard to catch because it follows the rules—until it doesn’t. It slips past fraud filters, and since it comes from real customers, it’s tough to flag or prevent. For many businesses, it’s not the big scams that cause the most damage—it’s this quiet, everyday kind.

Key characteristics of friendly fraud

Friendly fraud is tricky because it hides behind what looks like a normal transaction. Here’s what sets it apart:

- The transaction is real: The cardholder actually authorized the payment.

- The dispute comes later: Days or weeks after the sale, the customer contacts their bank claiming fraud, non-delivery, or an unauthorized renewal.

- The excuse sounds believable: Common reasons include “I don’t recognize this,” “My kid must’ve bought it,” or “I thought I canceled.”

- It’s harder to detect: The transaction passes fraud checks—IP, billing info, and behavior all look normal.

How it differs from traditional fraud

Traditional fraud is usually the work of outsiders—people who steal card info or hack into accounts to make unauthorized purchases, or cybercriminals who set up fake shopping websites to defraud their customers. Friendly fraud is different. The payment is legitimate, but the customer later denies it through a chargeback.

That’s what makes it so tricky. You’re not stopping a suspicious-looking transaction—you’re dealing with a real customer who turns around and files a dishonest claim.

Friendly fraud vs. refund abuse

At first, friendly fraud and refund abuse can look similar, but they’re not the same.

Refund abuse usually happens before a chargeback, and it’s more about exploiting a store’s return or refund policy. For example, someone might:

- Claim an item was never delivered, even though it was.

- Say a product was damaged just to get a refund.

- Use a return window to “borrow” something temporarily (think expensive outfits or electronics).

Friendly fraud skips over the usual steps. Instead of contacting the merchant, the customer goes straight to their bank and files a chargeback. The result? The refund gets processed before the business even knows there’s a problem.

Both refund abuse and friendly fraud are forms of post-transaction fraud, but friendly fraud is harder to catch—and even harder to fight without the right tools and a clear strategy.

What causes friendly fraud?

Friendly fraud can happen for a lot of reasons. Sometimes it’s an honest mistake. Other times, it’s flat-out abuse. And in many cases, it falls somewhere in between. That’s why experts often refer to it as part of a chargeback spectrum—ranging from accidental disputes to calculated fraud.

Let’s look at the most common causes:

Accidental friendly fraud

Not every chargeback comes from a bad actor. In fact, accidental friendly fraud is surprisingly common—and often overlooked.

It can happen when:

- A family member made the purchase without telling the cardholder; common with kids, teens, or shared accounts.

- The charge looked unfamiliar on a bank statement, especially if the merchant name appeared differently than expected. Many chargebacks happen this way, so using clear billing descriptors is a good way to prevent confusion and avoid disputes.

- The customer forgot about a subscription renewal and assumed it was an unauthorized purchase.

- The product was delayed, and the customer assumed it wasn’t coming.

- The customer didn’t recognize a digital goods charge, thinking it was a scam or billing error.

Deliberate friendly fraud

Then there’s the other side of the coin: deliberate friendly fraud—also known as first-party fraud or chargeback abuse. This happens when someone knowingly takes advantage of the chargeback system to get their money back while keeping the goods or services.

Some do it once. Others make a habit of it. Why do people do it? Here are a few reasons:

- Buyer’s remorse: They regret the purchase but don’t want to go through the official return process.

- Exploitation of digital goods: Physical items often come with tracking and delivery confirmation—proof a merchant can use to fight a chargeback. With digital products, there’s usually no solid delivery trail, making it easier for customers to claim they never received them.

- Recurring subscription charges: A customer signs up, forgets about the renewal, and when they see the charge later, they file a dispute—saying they never meant to authorize it. This type of friendly fraud is common with stored payment methods, where customers may forget they agreed to recurring billing.

- Opportunism: They know the system favors the customer, so they abuse it.

Institutional factors (Banks and card networks)

Sometimes it’s not just the customer—banks and card networks play a role, too. They’re under pressure to protect their users, so they often side with the cardholder by default, especially when a dispute sounds even halfway reasonable.

Some outdated systems also leave merchants vulnerable to newer tactics—like online address change scams, where fraudsters intercept deliveries and later claim the item never arrived.

Here’s what makes it worse:

- Easy access to chargebacks: Many banks allow customers to file a dispute with just a few clicks, no questions asked.

- Limited merchant involvement: In some cases, the merchant isn’t notified until the chargeback is already processed.

- Lack of awareness: Many banks don’t explain to customers that disputing a valid charge is considered refund fraud, so customers may not even realize they’re doing something wrong.

- Outdated policies: Some chargeback rules haven’t kept up with how people shop today—especially in cases involving digital goods or recurring online services, where proof of delivery or authorization can be harder to pin down.

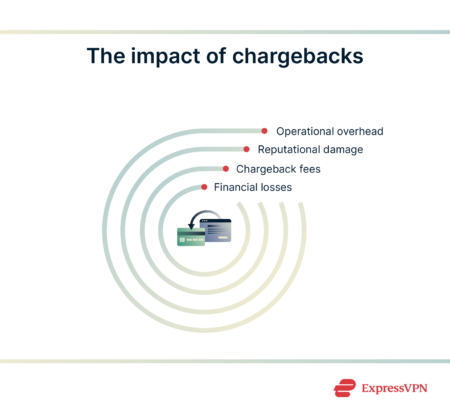

The impact of friendly fraud on merchants

Friendly fraud often starts with one chargeback—but it rarely stops there. A single false chargeback claim can quickly turn into a pattern, and over time, the losses add up.

The real impact goes way beyond a single refund.

Financial losses

The most obvious hit? Lost revenue. When a chargeback is filed, the money is pulled from your account, and if you’re selling physical goods, you’ve also lost the product and the cost of shipping. With digital goods, there’s no item to return, so the loss is instant and total.

Even worse, many friendly fraud chargebacks happen after the return period has ended, leaving you with zero options for recovery. Over time, these chargebacks quietly chip away at your margins and can seriously impact profitability if left unchecked.

And it’s bad financial news for customers, too—because when merchants lose significant revenue thanks to friendly fraud, they have no choice but to raise their prices.

Increased chargeback fees

On top of lost revenue, merchants often get slapped with chargeback fees from payment processors. These aren’t small—according to the U.S. Chamber of Commerce, they typically range from $20 to $100 per incident.

And if chargebacks keep coming, the costs don’t stop there. If your business crosses certain thresholds, you could be labeled a “high-risk” merchant. That means:

- Higher processing fees.

- Stricter fraud checks.

- Potential freezing or termination of your merchant account.

Reputational damage

Chargebacks don’t just cost you money. They also hurt your standing with banks and payment platforms. Too many can trigger fraud alerts, stricter rules, or even account freezes.

Get listed on a deny list or blacklist, and things get harder. You might struggle to open new accounts, partner with vendors, or process payments reliably. These records stick—and they tend to follow you.

Customers notice, too. If you’ve had to tighten refund policies or delay services because of past abuse, it can lead to frustration and negative reviews—even if you’re just trying to protect your business.

Operational overhead

Dealing with friendly fraud takes time, and a lot of it. Every dispute requires digging through transaction records, building a case, submitting evidence, and following up with banks.

Multiply that by dozens of disputes, and you’re suddenly spending hours, or whole teams, on chargeback dispute resolution instead of growing your business.

And it doesn’t end there. You’ll also need to:

- Train customer service staff to spot potential unauthorized purchase disputes.

- Monitor refund patterns and suspicious activity.

- Keep detailed documentation for chargeback representment.

It’s not just about fighting back—it’s about managing the extra weight friendly fraud puts on your business, day after day.

How to identify and prove friendly fraud

By the time a chargeback lands in your inbox, the money is already gone. That’s what makes friendly fraud so frustrating; it doesn’t always look like fraud—until it’s too late. But there are ways to spot red flags early and build a strong case when disputes do happen.

Let’s walk through how to recognize the warning signs, what kind of documentation matters, and how to work with banks during the chargeback process.

Warning signs to watch for

While friendly fraud doesn’t always follow a pattern, certain behaviors should raise a red flag. Keep an eye out for:

- Disputes from first-time customers who made a large purchase or used express shipping.

- Multiple chargebacks from the same buyer, even across different accounts or email addresses.

- Multiple digital goods purchases, especially with instant delivery (streaming, software, memberships, etc.).

- Claims of non-delivery when tracking shows successful delivery.

- Disputes filed just outside your return window, avoiding your normal refund process.

Chargeback documentation

When friendly fraud happens, your best defense is solid documentation. This is what helps you challenge the claim through the chargeback representment process.

Here’s what to gather and organize:

- Proof of delivery, including tracking numbers and delivery confirmation.

- Screenshots or logs of digital goods being accessed or downloaded.

- Customer communication, like emails or chat transcripts.

- Copies of your refund and return policies, especially if they were agreed to during checkout.

- Screenshots of the checkout process, showing the customer accepted the terms.

- IP address and device data showing where the purchase happened and what device was used. If that matches the customer’s usual activity, it helps prove the charge was legit—not fraud. But keep in mind that these digital breadcrumbs also raise questions about how much personal data is being tracked and shared.

How to work with issuing banks

When it comes to friendly fraud, banks are often the final decision-makers. And while it can feel like the system favors the cardholder, how you handle these interactions makes a big difference.

Here are a few tips:

- Respond quickly: Banks usually give you a tight window (often 7–14 days) to fight a chargeback.

- Be clear and professional: Stick to facts. Avoid emotional language or blaming the customer.

- Follow the bank’s rules: Each card network (like Visa or Mastercard) has its own format for evidence. Make sure you submit it in the way they ask.

- Stay consistent: If your evidence is unclear or inconsistent, the bank will likely take the customer’s side.

How to prevent friendly fraud

Friendly fraud isn’t always predictable—but that doesn’t mean you’re powerless. The key to stopping it is building systems that protect you before, during, and after the sale.

Let’s break down the best ways to stay ahead of friendly fraud chargebacks and keep your business protected.

Pre-transaction strategies

A lot of e-commerce fraud prevention happens before the customer even clicks “Buy.” Putting the right tools and checks in place early can stop many bad actors, or confused customers, from slipping through.

Here’s what helps:

- Use fraud detection tools: Use tools that check IP address, location, device info, and customer behavior. They can catch suspicious activity before the payment even goes through.

- Enable strong customer authentication: This adds a layer of security at checkout. Two-factor authentication and tools like 3D Secure don’t just block stolen card fraud—they also make it harder for a customer to later claim they didn’t authorize the payment.

- Be clear before and after checkout: Show refund and subscription policies upfront and use transaction descriptors that customers will recognize on their bank statements.

- Use address verification tools: A mismatch between billing and shipping addresses isn’t always suspicious—plenty of people send gifts or order from work. But using tools like Address Verification System (AVS) can help flag cases where the billing info doesn’t match what’s on file with the cardholder’s bank. It adds an extra layer of protection and helps you spot risky orders before they go through.

Post-transaction monitoring

Your job doesn’t end after the sale. Keeping an eye on what happens after payment helps catch signs of post-transaction fraud before it escalates.

Here’s what you can do:

- Monitor order behavior: Big orders from new accounts, rapid-fire purchases, or shipping to other countries can all be red flags.

- Communicate with customers (and keep logs): Confused customers may dispute charges, so reaching out early can prevent chargebacks. Make sure to keep emails and chat logs, as this can help with fighting chargebacks later.

- Track delivery: Stick with shipping providers that offer tracking and delivery confirmation, especially for expensive items or digital products.

- Use chargeback services: Some tools can help with spotting false claims and submitting the right evidence should you need to.

Deny lists and blacklists

If someone commits friendly fraud, don’t wait for a repeat incident.

- Add them to a deny list: This prevents future purchases from the same email, IP address, or payment method.

- Use shared blacklists: Some fraud tools let businesses share data to spot and block repeat offenders across different platforms.

- Monitor suspicious patterns: If someone changes their name or email slightly but uses the same card or shipping address, flag it.

Educating customers and setting clear policies

A big chunk of friendly fraud comes from confusion, not malice. That’s why clear communication matters just as much as strong security.

Here’s what helps:

- Keep policies clear and visible: Explain how refunds, returns, and subscriptions work—don’t hide them in the fine print.

- Send clear order emails: Include return steps and contact info to avoid unnecessary chargebacks.

- Offer fast support: Quick replies via chat or email can solve problems before they turn into disputes.

- Briefly explain chargebacks: A short note encouraging customers to contact you before going to their bank can help prevent friendly fraud.

Fighting friendly fraud chargebacks

Even with the best prevention tactics, some chargebacks will still slip through. When they do, you need to be ready, not just to respond, but to fight back effectively. That means understanding the process and understanding how to build a solid case.

How the chargeback representment process works

When a customer files a chargeback, your payment processor notifies you. At that point, you have the option to accept the loss or challenge it through chargeback representment.

Here’s how the process typically works:

- You receive a dispute notice with a reason code (e.g., “unauthorized transaction” or “item not received”).

- You gather evidence to prove the transaction was valid. This can include:

- Proof of delivery or download.

- Screenshots of customer activity.

- A copy of your refund and return policy.

- Records of customer support conversations.

- You submit your response within the deadline, usually 7 to 14 days.

- The issuing bank reviews the case and decides whether to uphold the chargeback or return the funds to you.

Visa, Mastercard, and other card networks each have their own rules for what counts as valid evidence. Some disputes can drag on, but in most cases, that first response matters most.

Keep things clear and organized. If the bank can quickly see the charge was legit, your chances of winning increase significantly.

Legal and ethical considerations

Friendly fraud may seem legally unclear, but merchants still have options—depending on location and card network rules.

Is friendly fraud illegal?

Yes, friendly fraud is still fraud, even if the customer is the cardholder. Filing a chargeback under false pretenses, such as claiming an item wasn’t received when it was or saying a transaction was unauthorized when it wasn’t, qualifies as refund fraud or first-party fraud.

That said, enforcement is tricky. Most banks don’t investigate minor cases deeply, especially if it seems like a misunderstanding. Unless the fraud is part of a larger or repeated pattern, it rarely gets escalated to legal authorities.

Still, merchants can document these cases and report them to card networks or fraud databases to help flag repeat offenders.

Can merchants take legal action?

In some cases, yes; merchants can sue for chargeback abuse, especially when there’s clear intent to deceive and a documented loss.

Legal action is more common when:

- The disputed amount is high.

- The customer has done it before.

- You have strong evidence (like delivery proof, emails, or accepted terms).

But let’s be real: small businesses don’t always have the time or resources to go to court over a $50 chargeback. In practice, legal action is often a last resort and more common among large retailers or platforms with legal teams.

Still, even sending a formal warning or reporting a case to a fraud database can serve as a deterrent.

Jurisdictional differences and card network rules

Laws and protections vary depending on where you and your customers are located. Some countries favor consumers with strong protections, while others give merchants more room to push back.

Many countries require extra steps to confirm the buyer’s identity during checkout—like entering a code from their bank or using a banking app. These checks make it harder for someone to later claim they didn’t approve the charge.

Visa and Mastercard also have their own chargeback rules, which affect how disputes are handled and how long you have to respond. If your dispute rate gets too high, card networks might raise your fees or issue fines—even if the chargebacks aren’t your fault.

The smartest move? Know the rules that apply to your business—and keep an open line of communication with your payment processor. They can help you stay ahead of policy changes, dispute deadlines, and other requirements that could impact your chargeback success rate.

Real-life examples of friendly fraud

Friendly fraud shows up in all kinds of everyday situations. These real-world examples help paint a clearer picture of how it plays out.

Disputing a child’s purchase

A parent hands a tablet to their kid, not realizing it’s still logged into the app store. A little while later, there’s a $60 in-app charge. Instead of reaching out to the merchant, the parent files a chargeback, saying the purchase wasn’t authorized. But it came from their own account—making it a classic case of friendly fraud.

“Item not received” scam

A customer places an order, receives it, and even leaves a review. Then, out of nowhere, they file a chargeback saying the item never arrived. It happens more often than you’d think, and without clear delivery proof, there’s not much the business can do.

Trial subscription chargebacks

Someone signs up for a free trial, forgets to cancel, and gets billed when it ends. Instead of contacting the company to ask for a refund or clarification, they file a chargeback, saying the charge wasn’t authorized. It’s common with digital subscriptions, where there’s nothing physical to prove the service was accessed or used.

Holiday and seasonal patterns

Friendly fraud tends to spike during busy shopping seasons—like Black Friday, Cyber Monday, or the winter holidays. Some customers buy gifts, use them, and then claim they were never delivered or arrived damaged. Others feel rushed or overwhelmed and end up disputing charges they don’t fully recognize. Whether it’s refund abuse or a chargeback filed in bad faith, these cases often increase when online shopping is at its peak.

FAQ: Common questions about friendly fraud

What percentage of chargebacks are friendly fraud?

The percentage of chargebacks attributed to friendly fraud vary depending on the industry, data source, and how friendly fraud is defined. That said, most estimates fall within the 60% to 80% range. Friendly fraud is especially common in e-commerce, where fraud detection is harder, and even more so with digital goods or subscriptions that are difficult to track after delivery.

Can you go to jail for friendly fraud?

Yes, friendly fraud is still legally considered fraud. But most one-time cases aren’t prosecuted. That said, repeat offenders—or those involved in larger patterns of abuse—can face legal action, including fines or even criminal charges.

How do I know if a chargeback is a friendly fraud?

Look for signs like a confirmed delivery followed by a dispute, customers who skip support and go straight to their bank, or repeat chargebacks from the same buyer. These patterns are common with friendly fraud.

How long after a purchase can a friendly fraud chargeback be filed?

Most banks give customers up to 120 days to file a chargeback. But this window can vary depending on the reason for the dispute, the type of product, and the policies of the card network or issuing bank.

Do banks investigate friendly fraud claims?

Banks perform basic checks but often default to siding with the cardholder—especially if the merchant doesn’t submit strong evidence quickly. That’s why detailed documentation is key to winning disputes.

What’s the difference between true fraud and friendly fraud?

True fraud involves someone using stolen payment info or hacking an account. Friendly fraud happens when the real customer files a dispute after a legitimate transaction—sometimes out of confusion, other times to avoid paying.

Is friendly fraud traceable by merchants or banks?

Yes, especially when merchants collect data like IP address, device info, account activity, and delivery confirmation. But connecting those dots often requires manual effort and solid recordkeeping.

What are the most common types of friendly fraud?

Common examples include “item not received” claims, disputes over digital or subscription services, and unauthorized purchases made by kids or other family members on shared accounts.

30-day money-back guarantee